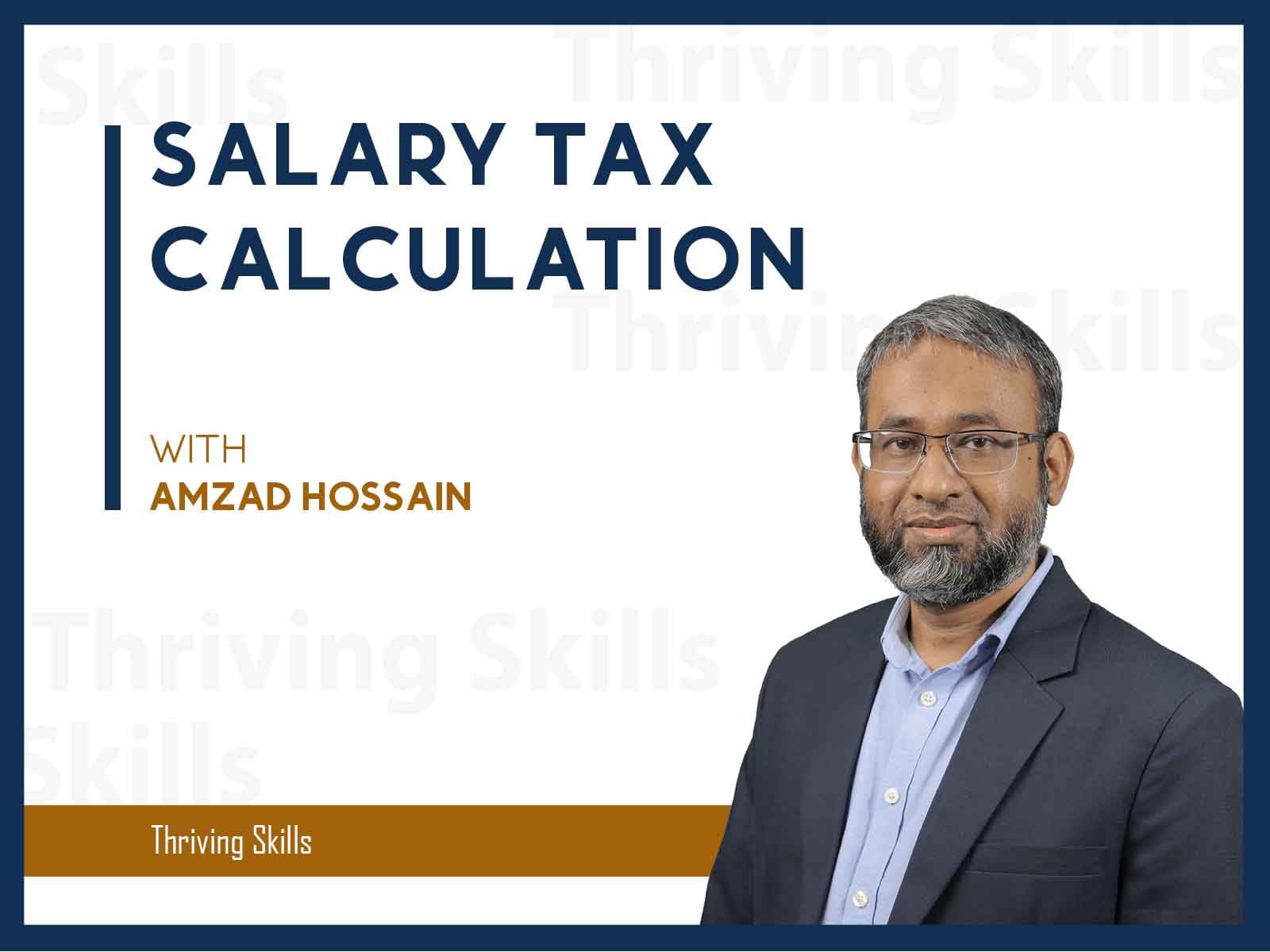

Salary Tax Calculation

Course Outline: Basic concepts – relevant definitions in tax law Salary components and its tax implications Optimizing tax benefit, minimizing charge Mandatory Statutory return and their preparation Tax law for – Workers’ Profit Participation Fund Provident Fund Gratuity Fund Q & A session Note: After completing every lesson click on the “COMPLETE” button the go to the next lesson. Must set up your first name, last name, and display name from settings of your profile for your certificate. don’t click on the “FINISH COURSE” button. If you click on the “FINISH COURSE” button then the course will be finished and a …

Curriculum

- 1 Section

- 14 Lessons

- 204 Weeks

Expand all sectionsCollapse all sections

- Salary Tax Calculation14

- 2.1Introduction5 Minutes

- 2.2Class materials

- 2.3Basic Concepts15 Minutes

- 2.4Salary Components part-115 Minutes

- 2.5Salary Components part-217 Minutes

- 2.6Optimizing Tax Benefit17 Minutes

- 2.7Charge of Income Tax8 Minutes

- 2.8Case Solution11 Minutes

- 2.9Deduction at source from Salaries4 Minutes

- 2.10Statutory Returns3 Minutes

- 2.11Workers’ Profit Participation Fund7 Minutes

- 2.12Provident Fund9 Minutes

- 2.13Gratuity Fund5 Minutes

- 2.14Conclusion5 Minutes

Overview

Course Outline:

- Basic concepts – relevant definitions in tax law

- Salary components and its tax implications

- Optimizing tax benefit, minimizing charge

- Mandatory Statutory return and their preparation

- Tax law for –

- Workers’ Profit Participation Fund

- Provident Fund

- Gratuity Fund

- Q & A session

Note:

- After completing every lesson click on the “COMPLETE” button the go to the next lesson.

- Must set up your first name, last name, and display name from settings of your profile for your certificate.

- don’t click on the “FINISH COURSE” button.

- If you click on the “FINISH COURSE” button then the course will be finished and a Certificate will be generated.

- More details: https://thrivingskill.com/faqs/

Training Instructor: