How to submit your income tax eReturn

Preparing for eReturn

Understand the Basics of eReturn:

If you’re new to filing your income tax return online, the eReturn system is a user-friendly option. It’s designed for taxpayers who want to do their taxes without the need for in-depth tax knowledge. Here’s how to get started:

Determine if You Need a Tax Software Program:

Tax software programs, like eReturn, are beneficial for anyone looking to file their taxes independently without the cost of hiring a professional tax preparer.

Gathering Necessary Information: Before you start using the eReturn system, make sure you have the following essential items at hand:

- A biometrically verified mobile phone and eTIN numbers

- A laptop or desktop computer for optimal performance

- Required documents like salary certificates, investment details, bank statements, property information, and more

- Remember, you don’t need to attach any documents to the eReturn; just fill in the relevant fields.

Using a Laptop or Desktop: For the best experience, it’s recommended to use a laptop or desktop computer when using the eReturn system. Mobile devices may not display all the user-friendly features.

Updating Your Phone Number If you’ve changed your phone number since your TIN registration, it won’t be a problem. You can use your current biometrically verified phone number for the eReturn.

Password Requirements Your eReturn password should have a minimum of 8 characters, including at least one lowercase character, one uppercase character, one digit, and one unique character (e.g., @, #, %, &, etc.). A password checker is available when using a laptop or desktop.

Registration Process To register for eReturn, you’ll need a biometrically verified phone number. Check your phone’s verification status by dialing *16001#.

Submitting Supporting Documents You do not need to attach any documents to your online submission. The assessment will be completed within the system, and you’ll receive a system-generated acknowledgment slip.

Entering the Income Tax eReturn System

Getting Started with eReturn Once you’ve registered, you can enter the eReturn system by following these steps:

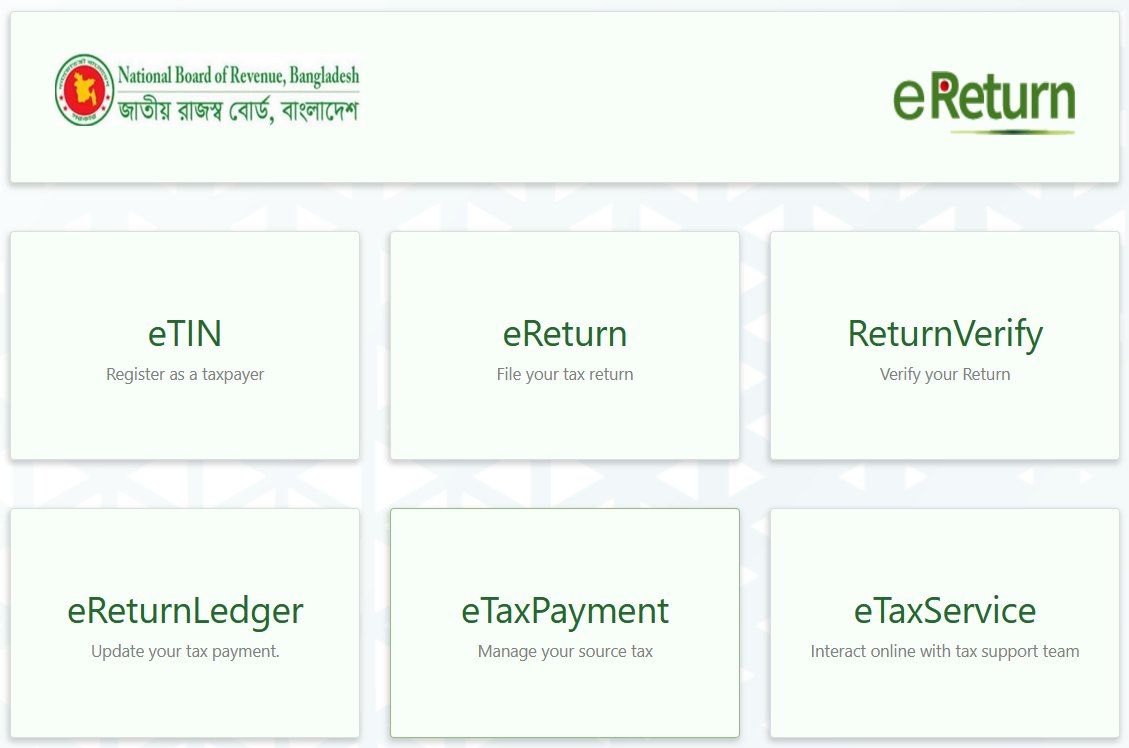

Visit https://etaxnbr.gov.bd/

- Click the “Registration” button and complete the registration process with your TIN and mobile number.

- After registration, click the “Sign In” button, set your password, and log in to the eReturn system.

After Signing In to eReturn System

Starting the Return Submission Process Now that you’ve logged into the eReturn system, you can begin the return submission process:

- On the eTaxNBR website, you’ll see four menus on the left: Home, Return Submission, and Tax Record.

- Click on “Return Submission.”

- Follow the step-by-step process and let the software guide you. Consult the User Manual or the Call Center if you need assistance.

The Return Submission Process The return submission process consists of seven steps:

- Enter the e-return system and log in

- Assessment Information

- Income details

- Additional information

- IT10B requirements

- Investment category & Rebate

- Expenditure

- Assets & Liabilities

- Tax and Payment

- Return View

- Download acknowledgement receipt

Each step requires you to provide specific information about your income, investments, expenses, assets, liabilities, and tax calculation.

Source Tax and Advance Tax If you’ve paid source tax and/or advance tax, you can prepare your paper return using the eReturn system and submit it to the tax office. Online verification for these payments is an ongoing process.

Making Online Payments You can make online payments through the eReturn system when filing your online return. Consult Chapter 6 of the User Manual for instructions on how to make online payments.

Tax Records

Benefits of eReturn Submission After submitting your return through the eReturn system, you’ll enjoy several benefits, including:

- TIN certificate in PDF format.

- Tax certificate.

- Acknowledgment slip.

- A verification link to prove online submission.

- Return document for download or printing.

- Generated challan copy.

- Access to your tax-related history through the eReturn system.

Filing your income tax return through the eReturn system is a convenient and user-friendly process that offers numerous advantages, making it a great choice for taxpayers looking to file their taxes independently.